Initial public offering

Initial public offering

The subscription period for Aiforia Technologies Plc’s initial public offering on the First North Growth Market was 29 November–8 December 2021. The final subscription price was EUR 5.01 per share in the institutional offering and in the public offering. Trading in Aiforias’s share commenced on the Nasdaq First North on 10 December. The ISIN code of the Shares is FI4000507934, and the trading code is AIFORIA.

About the initial public offering

Aiforia Technologies Plc aimed to raise gross proceeds approximately of EUR 27 million by offering a maximum of 5,393,657 new shares of the company for subscription. The number of new shares corresponds to approximately 21.3 per cent of the total number of Aiforia's shares after the offering assuming that the over-allotment option is not exercised. Assuming that the over-allotment option will be exercised in full, the offering consists of in total 5,992,459 Shares, corresponding to 23.1 per cent of the total number of shares after the offering.

The total number of Aiforia's shares after the offering will be 25,366,907 assuming that the over-allotment option is not exercised. Assuming that the over-allotment option will be exercised in full, the total number of Aiforia's shares will be 25,965,709.

Aiforia will receive gross proceeds of approximately EUR 30 million from the offering assuming that the over-allotment option will be exercised in full, and correspondingly approximately EUR 27 million assuming that the over-allotment option will not be exercised.

Aiforia in brief

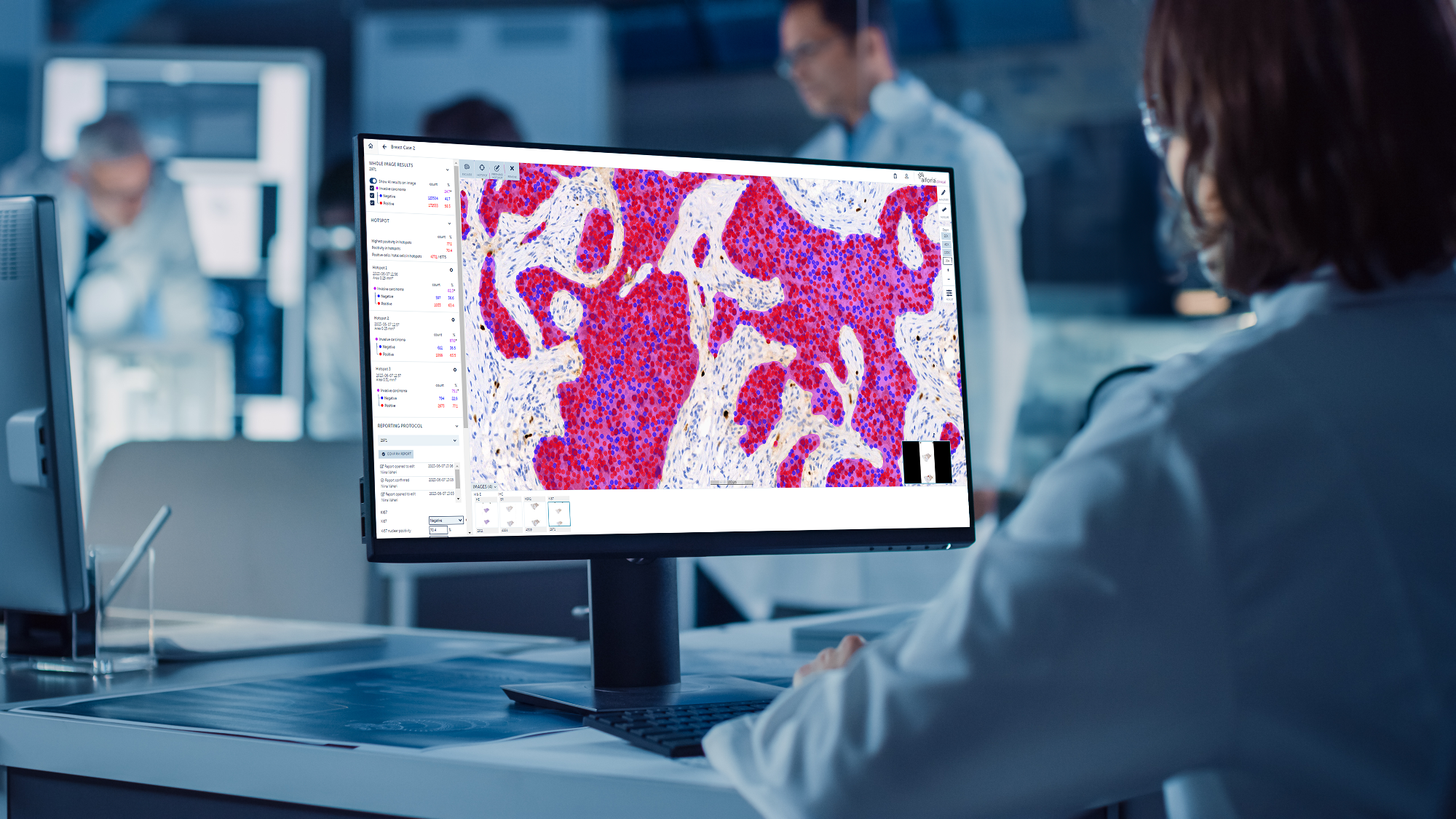

Aiforia is a Finnish company providing image analysis software utilising artificial intelligence (AI). The company’s business model is based on the development and utilisation of AI models in the analysis of tissue and cell samples relating to medical research and diagnostics.

Software solutions offered by Aiforia are aimed at automating diagnostic analyses and the most laborious parts of image-based diagnostics by utilising deep learning AI models and cloud-based image management.

The company intends to use the net proceeds from the initial public offering to support the company's growth strategy predominantly in the following way: approximately 50% to sales and marketing, and approximately 50% to research and development as well as other operational purposes.

Aiforia’s strengths

Aiforia’s management believes that the following factors, in particular, are the company’s key strengths:

Existing AI technology and software solutions

Cloud-based platform for managing, sharing and analysing large image files

High-level competence of the management and personnel particularly in pathology and AI

The versatility and adaptability of the software solutions to the customer's needs

Scalable business model

Releases

Press release, 5 November 2021:

Press release, 26 November 2021:

Press release, 26 November 2021:

The Finnish Financial Supervisory Authority has approved Aiforia's Finnish language prospectus

Company release, 29 November 2021:

Aiforia applies for its shares to be listed on Nasdaq First North Growth Market Finland

Company release, 9 December 2021: